Page Contents

President Biden Adopts Executive Actions To Increase Solar Energy

The 6th of June 2022, president Joe Biden announced two executive initiatives to increase both the U.S. solar manufacturing and installation industries. The first was an emergency Declaration of Emergency to address the shortage of solar panels within the United States, which has slowed the progress of many gigawatts (GW) of energy-efficient solar power projects. Another was the invoke under the Defense Production Act to increase the production of solar panels in the United States and other renewable energy technologies.

The Biden Administration is hoping that the two measures will boost U.S. solar manufacturing capacity by 20% over the current level and lead to as much as 100 GW more solar energy generation over 10 years, more than in the event that executive measures were not implemented.

Let’s examine the motives for the President’s actions as well as the long-term and immediate consequences they’ll bring, and the potential impact on the solar market for residential homes.

Key takeaways

- Vice President Joe Biden took action in June 2022 to boost the number of solar panels across the nation by putting off tariffs on solar panels from other countries which could threaten the U.S. solar industry.

- Also, the administration announced President will make use of the Defense Production Act to encourage investment in the manufacturing of solar panels in the coming two years.

- These two steps will boost capacity of solar capacity that will be built by 2022 and set the U.S. on the path towards a stronger manufacturing of solar panels in the coming years.

- In Biden’s proposal Biden’s plan, Biden’s plan is that the Federal government will be able to purchase up to 10 gigawatts worth of solar power over in the coming 10 years providing producers in the United States more assurance that they can market their products.

- The Biden Administration’s policies will ensure that the residential solar industry running by allowing U.S.-based producers to continue to import key components for solar panels and also to expand their capacity to manufacture the materials themselves inside the U.S.

- The prices for solar panels for homes aren’t likely to alter much in the next couple of years because of the shortages in supply and the eventual transition into U.S.-based manufacturing.

What specific steps did the President decide to take and for what reason?

In the issuance of an urgent declaration with an emergency declaration, President Biden ordered his Secretary of Commerce to allow for a period of 24 days “the importation, without the collection of duty and estimated duty… of specific solar modules and solar cells” that originate from the 4 Southeast Asian countries: Cambodia, Malaysia, Thailand, and Vietnam. This was due to the request from U.S. solar module maker Auxin Solar, which asked the Commerce Department to investigate whether solar technology from these countries was being offered by Chinese firms in an effort to get around the existing trade barriers against dumping.

In the event of fears that tariffs could result due to the investigation, many solar companies in the countries that were targeted stopped shipping their products in America. U.S. in the spring of 2022. This had a significant impact on the estimates of solar installations. If tariffs had been put in place this would have led to an increase of 50% on solar power installations throughout the remainder of the entire year. With no tariffs for the duration of 24 months, firms will be able to restart their production lines, however, it will take some time until the solar industry can catch up, and some projects may remain delayed.

In conjunction in the wake of the Emergency Declaration, Biden announced he will make use of the Defense Production Act (DPA) to help spur the growth of U.S.-based manufacturing of clean energy. This will ensure there is a guarantee that the United States has enough manufacturing capacity to meet the needs of the solar installation business when the time limit of 24 months on the new tariffs comes over.

The decision to make use of the DPA signifies it is expected that federal officials will sign specific multi-part agreements with manufacturers of solar equipment. These contracts, known as “Master Supply Agreements” will guarantee producers that government agencies will purchase a specific amount of solar panels and insist that the panels be manufactured using a specific proportion of U.S.-sourced products and labor.

In addition to solar-powered equipment In addition to solar equipment, the Biden administration has also enacted solar equipment. Biden administration is also called for the DPA to encourage the domestic production of energy-saving and clean technology like the insulation of heat pumps and heating systems, and equipment for the production of green fuel cells and grid infrastructure. In total, Biden’s initiatives are intended to speed up the transition of the nation towards clean energy. But can they?

What effect can these actions have?

The immediate impact of Biden’s executive decisions is the resumption of a number of large-scale solar projects which were put off as they were under investigation Commerce Department investigation loomed. A reputable expert estimates that the investigation was stalled the development of 6 Gw of solar power projects and Biden’s Emergency Declaration would lead to between 2 and 3 the GW of those projects getting their projects back on track.

In 2023, manufacturing facilities of the four countries of the target will be restored fully operational as well as the solar utility pipeline reinstated. Stateside manufacturing will also rise due to the DPA order that promises companies that with federal support to purchase their products when certain conditions are satisfied.

For clarity, the Biden directive does not end the Commerce Department’s investigation but it has delayed its probable outcomes to 24 years. If the investigation concludes that Chinese firms are evading taxes and choose to impose additional tariffs on imports coming from the four countries mentioned the tariffs will go into effect by the middle of 2024. U.S. solar manufacturing capacity will need to be in better condition by then.

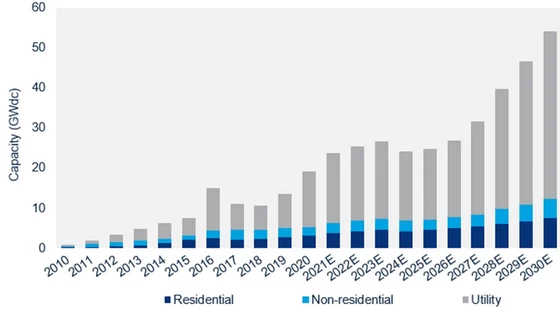

Prior to Biden’s recent order, industry analysts from Wood Mackenzie predicted an estimate that U.S. would see demand for about 30 gigawatts of solar by 2023, and greater than 50 GW annually until 2030. The majority of solar panels employed in domestic installations originate from outside the United States. Should the Commerce department decides to impose major new tariffs on solar panels imported from abroad producers will probably decide to build new plants within the U.S.

In the last quarter of the year, 2020 U.S. solar manufacturers produced (and sold) 7.5 GW of solar panels annually. In order to cover the gap in the demand for domestic solar panels in there is a need for the U.S. would need to witness at minimum of 15GW new production capacity coming into operation by 2024. That’s exactly what Biden’s estimate.

In addition to the demand already in place, the Biden administration has stated that it expects that the U.S. government will buy at least 10 GW of American-made solar panels in the coming 10 years and wants local and state governments to get involved, and estimates that there could be 100 GW demand from government for solar panels in the coming decade.

The possibility of taxes on imported solar modules and cells as well as the rising demand for domestically-produced solar modules will be enough to attract lots of new investment within U.S.-based production facilities. In the longer term, this could result in less expensive prices and more options. But does this mean lower costs to the typical American consumer?

What do these mean for homeowners?

It’s probably not that as much, at the very least for the beginning. The majority of U.S. home solar installations are already using US-made panels made by Qcells, Silfab, Jinko, and others. The manufacturers make modules across the country, and they buy their solar panels as well as the cells that are used in these modules from the four countries that are part of investigation by the Commerce Department investigation.

The one-year pause on the tariffs is going to mean U.S.-based producers can continue to source materials for solar panels in the way they have always done and can sell their products at roughly the same cost prior to the investigation. However, due to the risk of tariffs looming in the next 24 months, these producers will need to adjust to fabricating themselves silicon wafers and solar cells or buying the parts through U.S. manufacturers.

This means that manufacturers in the U.S. will have to hold or raise their prices over the next years as cell and wafer production in the United States grows. In the long run switching to domestic production of components needed for solar panels will provide a variety of advantages for America. U.S. in terms of employment, energy security and corporate earnings, however, cost savings for consumers are not expected.

In addition, considering there is a chance that the Federal solar tax credit is scheduled to be phased down in the coming year and then disappear in 2023. this is the perfect time to get solar panel systems. If you’re thinking of installing solar panels in the future after 2023, and you want they to be affordable, then call your representatives and request for their support of their support for the Build back better agenda that includes provisions to offer new solar financing and also make the tax credit completely refundable.