There have been two linked and intensely consequential March developments inside the Electrical Reliability Council of Texas (ERCOT), the grid operator that serves about 90% of {the electrical} power demand in Texas.

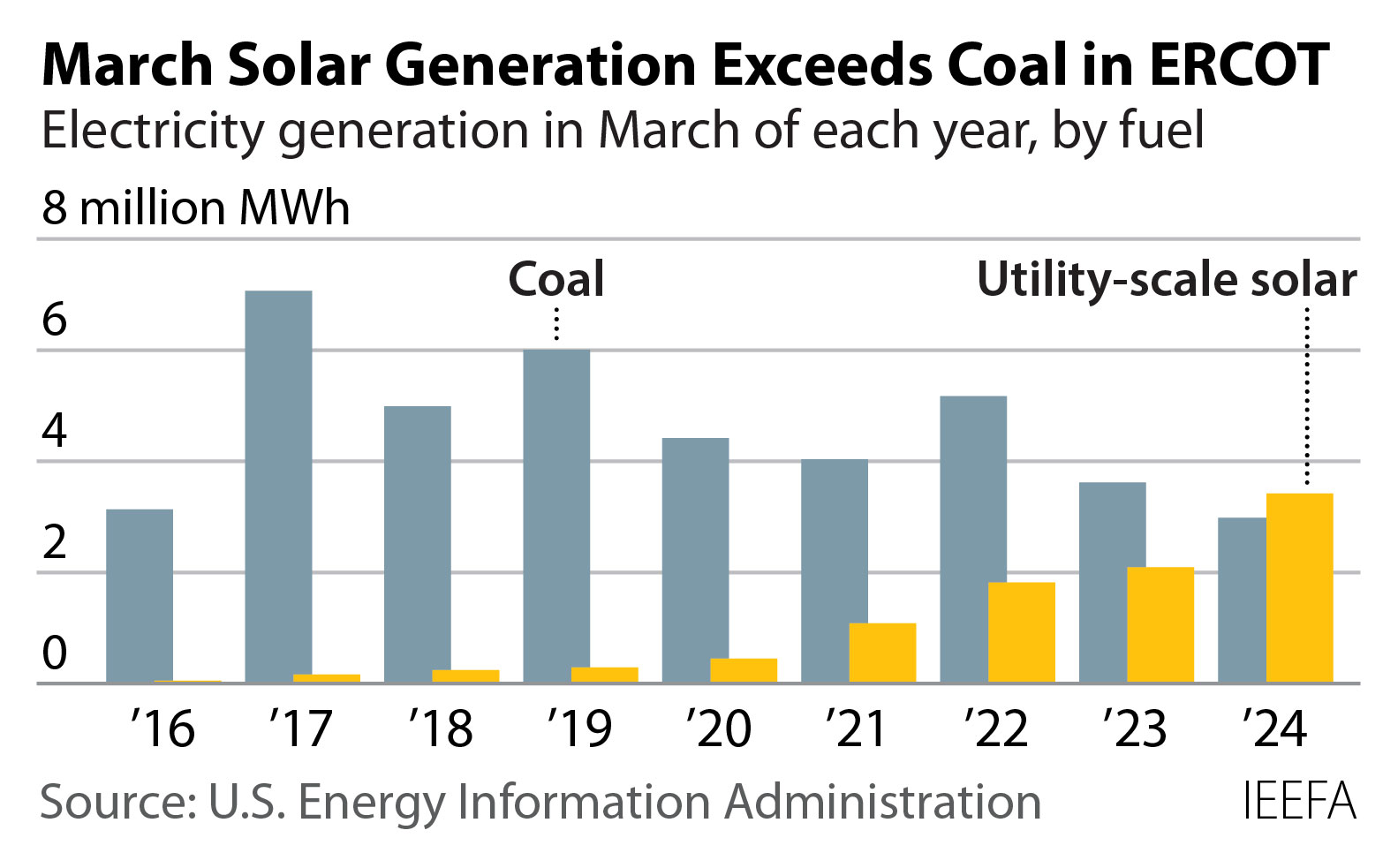

First, picture voltaic expertise topped coal’s output for the primary time in any month, sending 3.26 million MWh onto the grid vs. the 2 96 million MWh outfitted by coal. Second, coal’s market share fell below 10% for the primary time, to solely over 9%. The decline continued a long-term slide that began a decade previously nevertheless has picked up velocity since 2016-17, when picture voltaic was first confirmed in ERCOT’s expertise data.

For all of 2017, picture voltaic generated merely 0.6% of ERCOT’s demand or 2.26 million MWh. In March 2024 alone, picture voltaic expertise reached 3.26 million MWh, in response to the Energy Information Administration’s (EIA) hourly grid monitor. The rise pushed picture voltaic’s share of ERCOT expertise to higher than 10% for the month, moreover a main.

Whereas picture voltaic has been climbing steadily (see the graphic below), there was a notable pickup nowadays. Period in March 2024 was 1.17 million MWh higher than 12 months previously, a 56% enhancement, and the growth will proceed. ERCOT data displays that the system presently has 22,710 MW of operational picture voltaic functionality nevertheless is anticipated to extend by practically one-third by the highest of the 12 months as one different 7,168 MW of functionality is added. The decide counts solely initiatives which have a signed interconnection settlement and have put apart the financing required to get onto the ERCOT grid. Further progress is on the tap for 2025, the place initiatives with 20,932 MW of functionality are in an an identical stage of development. There are actually 1000’s of additional megawatts of picture voltaic functionality in earlier phases of development.

In distinction, coal’s share of the ERCOT market has been falling, practically in reverse lockstep to picture voltaic’s progress. From 2003 to 2014, coal’s annual share of ERCOT demand ranged from 36% to 40% (other than 2012, when low prices elevated gasoline expertise and coal dropped to a 33.8% market share). Since then, the decline has been quick. The ultimate 12 months coal topped the 30% mark was 2017; by 2018, coal had dropped below 25%; was beneath 20% in 2020; and was decrease than 15% closing 12 months, supplying merely 13.9% of the system’s full demand.

Importantly, the annual frequent should not be skewed by a couple of months of terribly low expertise. Comparatively, coal’s market share in ERCOT is declining all through the board, even all through the sweltering summertime months. No month topped 20% in 2022, and solely November marked higher than 15% in 2023. The sample should not be extra prone to change in 2024. Data for the first three months put coal’s market share at 16.1% in January, 10.3% in February, and March’s first-ever sub-10% diploma.

Coal’s decline in ERCOT has important implications for the U.S. normal since Texas has lengthy been the most important particular person of coal for power expertise. In 2023, the state burned 50.7 million tons of coal for electrical power — twice as lot as second-place Missouri’s 24.1 million tons — and 13% of the U.S. full. Data from the EIA grid monitor (see graphic below) displays that coal’s share of nationwide electrical expertise was decrease than 15% day after day in March — the first time that has occurred. Coal’s nationwide market share moreover hit a day-by-day file low on March 29, dropping to solely 11.25%.

Coal’s poor March effectivity is notable because of in latest instances it has been April and May — with common temperatures, longer days, and common winds — when its nationwide market share has been at its lowest, and it is utterly attainable that it’d fall into the one digits on some days this spring.

These shifts in power manufacturing — picture voltaic’s rising place, and coal’s decline inside the nation’s most power-hungry state — current merely how substantial the modifications have developed inside the energy transition.

Info merchandise from the Institute for Energy Economics and Financial Analysis (IEEFA)